LEVERAGE

Leverage is the use of various financial instruments or borrowed capital, such as margin, to increase the potential return of an investment. Prior to exploring leverage and how it used in trading with Full Options Trades, please carefully read the following Risk Warning on Leverage:

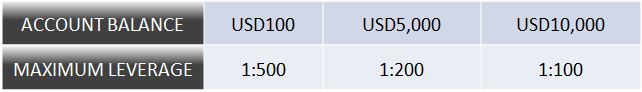

LEVERAGE AMPLIFIES POTENTIAL LOSSES OR GAINS. WITHOUT PROPER USE OF RISK MANAGEMENT, THE HIGH DEGREE OF LEVERAGE MAY LEAD TO LARGE LOSSES. Full Options Trades offers variable levels of leverage depending upon account balance.

Leverage on Metal products is always fixed at 1:100

Advantage of lower leverage?

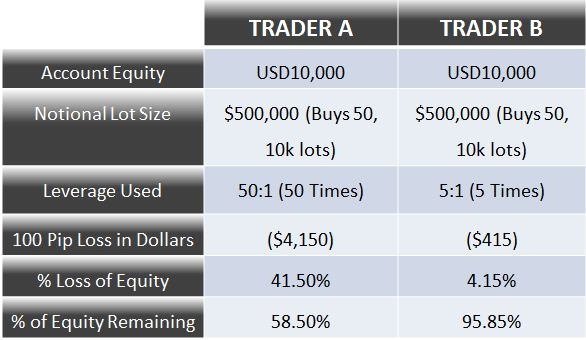

When you use excessive leverage, a few losing trades can quickly offset many winning trades. To clearly see how this can happen, consider the following example.

Scenario: Trader A buys 50 lots of USD/JPY while Trader B buys 5 lots of USD/JPY.

Questions: What happens to Trader A and Trader B account equity when the USD/JPY price falls 100 pips against them?

Answer: Trader A loses 41.5% and Trader B loses 4.15% of their account equity.

Example:

By using lower leverage, Trader B drastically reduces the dollar drawdown of a 100 pip loss.